Almost two years after its launch in collaboration with the Council on Economic Policies (CEP), a new version of the Global Tax Expenditures Database (www.GTED.net) has been released. Since June 2021, the number of reporting countries has risen from 97 to 106.

©GTED

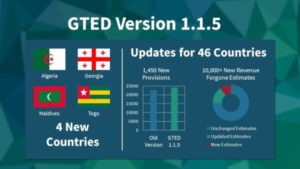

In its most recent update, four countries (Algeria, Georgia, Maldives, and Togo) that have just released their first tax expenditure reports have been added to the database. In addition, new information from 46 countries has been incorporated and the GTED has grown by more than 10.000 new revenue forgone entries. However, much remains to be done since there are still 112 non-reporting countries that have never published any tax expenditure reports, and the quality and scope of the existing information varies widely.

The GTED is the cornerstone of IDOS’s efforts to contribute to greater Transparency and rationalisation of tax expenditures. These are deviations from benchmark tax systems that benefit specific groups, economic sectors or activities. Governments use them to pursue different policy goals, such as attracting investment, fighting poverty or dealing with unforeseen events. All too often, however, the benefits of these measures are doubtful and their true costs unknown. As the new GTED version shows, their worldwide use has grown considerably, since many governments used tax expenditures as a crisis response to the COVID-19 pandemic. Revenue forgone from tax expenditures amounted to 30 percent of actual tax revenue and almost 4.4 percent of GDP in 2021, on average. This is much higher than the average 22.9 percent of tax revenue and 3.9 percent of GDP in the years 2000-2020.