Investment Facilitation for Sustainable Development: Index maps adoption at domestic level

Global investment needs are enormous in order to bolster the implementation of the 2030 Agenda for Sustainable Development and help in particular developing countries to recover from the effects of the Covid-19 pandemic. Foreign direct investment (FDI) flows not only bring capital to developing countries, but also employment, export opportunities, advanced technologies and managerial know-how. To harness the benefits of FDI, it is crucial that governments have policies, regulations and measures in place that help to attract and retain FDI and enhance its contribution to sustainable development.

Against this background, international discussions on better ways to facilitate the flow of investment have intensified. While international investment agreements are criticised due to their one-sided focus on the legal protection of foreign investors who can challenge host country laws and regulations by means of investor-state dispute settlement (ISDS), investment facilitation is being discussed as a new policy tool to promote FDI.

Investment Facilitation is not about the protection or liberalisation of foreign direct investments. It is about implementing practical measures to improve the transparency and the predictability of domestic investor-related systems.

Axel Berger Investment Facilitation for Sustainable Development: Index maps adoption at domestic level Share on X

In 2015, Brazil started to negotiate an innovative type of international investment treaty that focused on investment facilitation and cooperation. Furthermore, cooperation on investment facilitation has been on the agenda of global and regional fora such as the G20 and APEC and is promoted by international organisations such as the OECD and UNCTAD. A group of 69 WTO members signed a Joint Ministerial Statement on Investment Facilitation for Development Statement during the 11th Ministerial Conference in Buenos Aires in December 2017 calling for the start of “structured discussions with the aim of developing a multilateral framework on investment facilitation”. The WTO Structured Discussions started in March 2018 to identify possible elements of a potential international Investment Facilitation Framework. More countries joined the Structured Discussion and issued a second Joint Statement on Investment Facilitation for Development on 22 November 2019. Formal negotiations started in September 2020 among currently 106 countries with the aim of reaching a substantive outcome ahead of the 12th Ministerial Conference in 2021.

In 2015, Brazil started to negotiate an innovative type of international investment treaty that focused on investment facilitation and cooperation. Furthermore, cooperation on investment facilitation has been on the agenda of global and regional fora such as the G20 and APEC and is promoted by international organisations such as the OECD and UNCTAD. A group of 69 WTO members signed a Joint Ministerial Statement on Investment Facilitation for Development Statement during the 11th Ministerial Conference in Buenos Aires in December 2017 calling for the start of “structured discussions with the aim of developing a multilateral framework on investment facilitation”. The WTO Structured Discussions started in March 2018 to identify possible elements of a potential international Investment Facilitation Framework. More countries joined the Structured Discussion and issued a second Joint Statement on Investment Facilitation for Development on 22 November 2019. Formal negotiations started in September 2020 among currently 106 countries with the aim of reaching a substantive outcome ahead of the 12th Ministerial Conference in 2021.

In light of this dynamic policy process: What do decision makers, in particular in developing countries, need to make informed decisions about the negotiations of multilateral disciplines on investment facilitation? We believe more evidence is needed on the landscape of investment facilitation measures, challenges of developing countries as well as on possible scenarios of a multilateral agreement. We therefore:

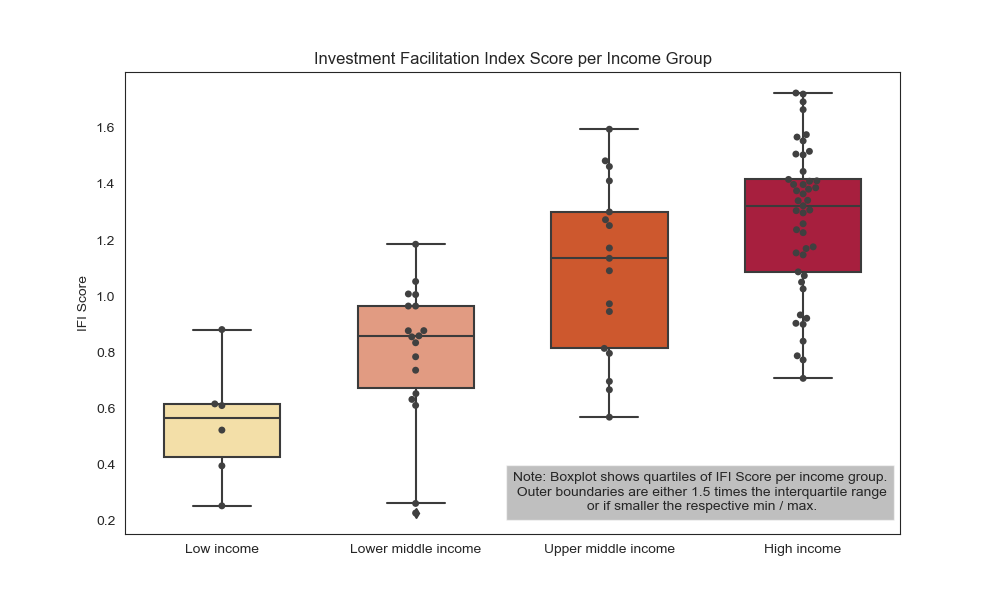

- Built an Investment Facilitation Index that helps to conceptualise the scope of investment facilitation and map investment facilitation measures at the country-level.

- Developed scenarios of possible international Investment Facilitation Frameworks and measured their economic impact.

- Identified developing countries’ challenges to implement investment facilitation measures.

- Developed policy proposals about how investment facilitation could better contribute to sustainable development.

The German Institute of Development and Sustainability (IDOS) conducts this research and policy advice in close collaboration with international partners including the World Trade Organization (WTO), International Trade Centre (ITC), University of Nebraska – Lincoln, Dadkhah Consulting and Deutsche Gesellschaft für internationale Zusammenarbeit (GIZ). Funding by the German Federal Ministry for Economic Cooperation and Development (BMZ) is gratefully acknowledged.

Schreibe einen Kommentar