This blog describes the infrastructure-related initiatives of the G20 Partnership with Africa, as set forth by the 2017 German G20 Summit. It proposes that (a) the G20 align its initiatives with key African agendas (e.g., the African Union’s Agenda 2063), (b) support the inclusion of civil society in key initiatives, and (c) ensure a fair balance of interests between private investors and citizens. Otherwise, with the megaprojects envisioned, including many Public-Private Partnerships (PPPs), African nations could experience greater debt distress; environmental destruction, and human rights violations.

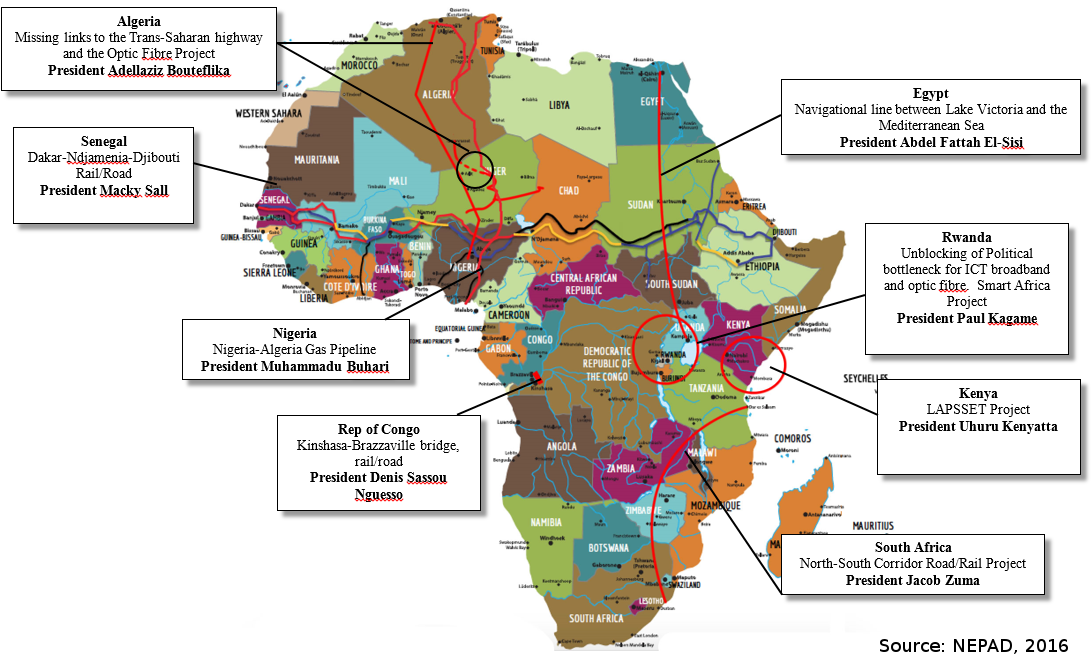

The G20 Partnership with Africa, highlights the G20 Compact with Africa (CwA), which aims at boosting private investment, especially in infrastructure. The G20 Leaders’ Declaration promises to “align our joint measures with regional strategies and priorities,” including the 10-year implementation plan of the African Union’s Agenda 2063 and its Programme for Infrastructure Development in Africa (PIDA). PIDA aims to invest US$360 billion up to 2040, especially in energy and transportation megaprojects, to access natural resources and markets to facilitate trade and commerce; and create jobs, among other things. (See map and critique.)

It is unclear whether the CwA has strong ownership, since it welcomes (but does not yet include) complementary measures by other G20 members, notably China, Japan, and the EU. Nor does the CwA draws strong links to either African commitments to realize sustainable development, climate goals or the AU’s Agenda 2063 or other G20 commitments, such as the G20 Action Plan on the 2030 Agenda or the G20 Climate and Energy Action Plan for Growth.

Seven countries have volunteered for the CwA and prepared investment overviews: Cote d’Ivoire, Ethiopia, Ghana, Morocco, Rwanda, Senegal, and Tunisia. These feature energy and transport infrastructure and most include agriculture, manufacturing and other projects. Public-private partnerships (PPPs) are the modality of choice (e.g. Cote d’Ivoire plans 114 infrastructure PPPs).

Map: PIDA’s master plans for megaprojects in energy, transport and water& eight champions in megaprojects

Support the inclusion of civil society in key initiatives

Peoples’ participation is crucial to project success, including protecting human rights and the environment; ensuring effective service delivery; preventing corruption; and aligning projects with national strategies, among other things (see OECD).

African civil society asks and deserves to be heard. For instance, why are some PIDA projects, such as the Nigeria-Algeria gas pipeline serving European markets, prioritized over others? What are the trade-offs between multiple megaprojects and smaller urbanization, off-grid electricity, or education projects? Could PIDA trigger the cycles of indebtedness and austerity that have battered these countries in the past?

There are examples how and where civil society participation could be fostered by the G20. The Mapping of Energy Initiatives and Programs in Africa reviews 58 energy related initiatives and found that there is a high-level of private sector participation in the initiatives, as compared to other African partners, including civil society. It found no civil society participation in PIDA.

The trend toward greater repression of civil society needs to be dramatically reversed. The G20 cannot dictate how African governments relate to their citizens, but it can listen to civil society and encourage civic (as well as the existing business) participation in Africa and, specifically, the compact countries. Moreover, it can also stop designing and financing initiatives (e.g., the PIDA Special Delivery Mechanism) that exclude civil Society.

Ensure a fair balance of interests between private investors and citizens

High-level decision-making occurs between heads of state and corporate leaders, including through the Continental Business Network (CBN). The CBN proposes attracting long-term institutional investors (e.g., pension funds) into African infrastructure. In a recent speech, World Bank President Kim envisioned a U.K. pension fund investing in and reaping returns from infrastructure in Africa. In aging societies, pension funds are desperate for high yields on their investments, but one wonders: for how many generations should African user fees support Northern pension funds and their elderly? Instead, more effort could be done to harness the estimated $50 billion leaving the continent annually as part of illicit financial outflows.

The G20 Compact with Africa by the World Bank, African Development Bank and IMF describes the roll out of “Guidance on PPP Contractual Provisions” that saddles governments with high risk and restricts the state’s “right to regulate” in the public interest in order to protect human rights and the environment. States relying on these provisions could be required to compensate investors for project delays due to strikes and protests. It also describes a Systemic Investor Response Mechanism to, among other things, address grievances and “strengthen capacity of the “offending” institutions to minimize the recurrence of such events.”

Governments’ engagement with African think tanks and civil society can help ensure that Africa gets a fair deal with its many Partners.

Schreibe einen Kommentar